Looking to improve the CIBIL score intact to make sure to keep up the good credit report for availing Loans, interests or any financial aid from Banks. Read this post fully to get some useful ideas about how to improve the CIBIL score.

What is CIBIL Score?

The Credit Score is a number that indicates an individual’s creditworthiness. It impacts the individual’s capability to borrow and take new credit from lenders. Usually, banks or lenders use this credit score to evaluate the probability of whether an individual repays his debts or not.

The Reserve Bank of India in September 2016 had mandated every Credit Information Company (CIC) in the country to give one Free Full Credit Report (FFCR) to every individual starting from 1st January 2017. This detailed report mainly carries the Credit Score among other financial points. Due to this mandate, you can now check your CIBIL score for free once in a year. Many people are finding it hard to know how to check the CIBIL score online for free.

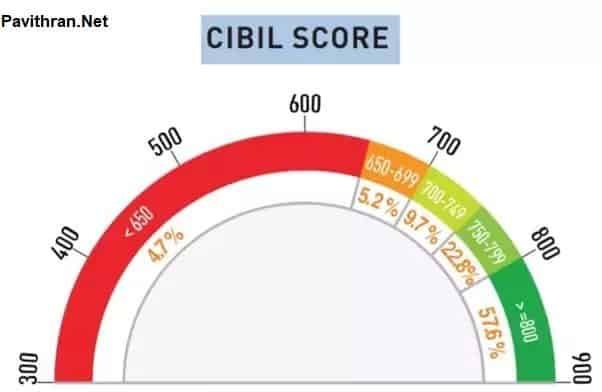

What is the Range of CIBIL Score? Which is a Good Score?

A CIBIL score ranges from 300-900, 300 being the lowest and 900 being the highest. Your CIBIL score should be closer to 900 to get the best deals on interest rates for loans. A CIBIL score of 750 and above (750-900) is considered as ideal by the majority of lenders like banks and non-banking finance companies (NBFCs).

Great – 800-900: This is a great score. It reflects an ideal track record of repayments and Timely payment of Bills with no credit history that means you get the great offers on various loans and credit cards.

Good – 600-799: If you are planning to apply for a fresh loan or a new credit card, this score offers a good chance that your application will be granted. A score in this range shows that you have handled your previous borrowings judiciously and are a safe borrower. You might have to pay higher interest rates

Bad – 300-599: This is considered as a poor (bad) CIBIL score and your chances of being approved for the new loans or credit card are very less in this case. The primary reason for getting this score can include the irregular repayments of the loan, Payment defaults or missing credit card payments.

Top 10 Websites to Check CIBIL Score for Free

- Cibil.com

- Paisabazaar.com

- BankBaazar.com

- HDFCBank.com

- Bajajfinserv.in

- Wishfin.com

- MyLoancare.in

- Indianmoney.com

How the CIBIL Score is affected?

Best way to Maintain the Good CIBIL Score:-

Quick Way to Increase the CIBIL Score:-

![YCT Assistant Professor Solved Papers 2024 [6 Subjects] PDF](https://www.pavithran.net/wp-content/uploads/2024/01/YCT-Assistant-Professor-Solved-Papers-2024-6-Subjects-PDF-1024x512.webp)